Is it possible to apply for both schemes?

A business cannot take out both kinds of loan. Before applying you should consider carefully which scheme will best meet your business’ needs.

Borrowers with CBILS loans of £50,000 or less may, however, be able to transfer the CBILS loan to the BBLS, provided that the business transfers the entirety of the loan. Any transfer from the CBILS to the BBLS will be subject to lender consent and terms, and so businesses should discuss such transfers with existing lenders. The government is currently considering whether to enable transfers of amounts greater than £50,000 from the BBLS to CBILS, but there has been no official confirmation on this point.

Can multiple applications be made with different banks to speed the process up?

It is theoretically possible to apply to multiple lenders, but borrowers should be transparent with lenders if they ask whether the applicant has applied to other lenders, and should be aware of the potential impact on credit rating (see “Will applying for CBILS or BBLS affect a business’s credit history?” below). To increase chances of success, it may be worthwhile targeting applications to lenders with whom you have an existing relationship. If your application with an existing lender has been refused, you might then consider applying to another lender.

Can multiple applications be made for different businesses units/operations, such as different pubs in a pub chain?

The CBILS and BBLS take different approaches to this:

CBILS

In principle, based on the guidance provided by the British Business Bank to date, it is possible to have different loans for different divisions or units. For example, it is theoretically possible for a publican that owns two different pubs to have two different loans, one for each pub. The issue, however, is that, when assessing eligibility for the CBILS, the turnover of different divisions or units will usually be aggregated together. As a consequence, it may be that the combined turnover of the units together exceeds the eligibility threshold. The CBILS maximum turnover eligibility criterion will apply to a corporate group as a whole, meaning multiple loans across a group are only permissible if the consolidated group turnover for the 12 months before the application does not exceed the £45,000,000 annual turnover threshold.

When determining group turnover, the following should be taken into account:

- Linked businesses: This is where one business holds a majority of the shareholders’ or members’ voting rights in another, or can appoint or remove a majority of the other’s administrative, management or supervisory body; or there is a contract between them enabling one to exercise a dominant influence over the other; or one can exercise sole control over a majority of shareholders’ or members’ voting rights in another

- Partner businesses: A partner business is an enterprise that has certain financial partnership with another, without one exercising effective direct or indirect control over the other. This will be the case where both businesses hold 25 per cent or more of the capital or voting rights in each other and are not linked to other enterprises

- Enterprises linked to any of the applicant’s partners, and any businesses linked to the applicant’s linked businesses.

BBLS

The BBLS does not permit multiple loans for different divisions. Only a single loan per borrower and its group is permitted under the BBLS.

Do businesses have to specify what the money will be used for?

The CBILS and BBLS require borrowers to provide certain confirmations relating to the use of funds:

- CBILS. Borrowers must confirm that the loan will only be used to support UK trading activity, and will need to provide a business plan showing how the loan will be used. For loans below £30,000, the borrower must also self-certify that the loan will not be used for certain activities outside of the UK

- BBLS. Borrowers must confirm that the loan will only be used to provide an economic benefit to the business, such as providing working capital, and not for personal purposes. They will also need to confirm that the loans will not be used for export activity

In addition, lenders will usually require borrowers to specify the purpose of the loan and how the funds will be used. How much detail is required will vary from lender to lender. Sometimes something as simple as “working capital purposes” will be sufficient, while other times granular detail will be required. Further to this, lenders often include conditions in loan agreements that require funds provided to be used for a specified purpose.

Will applying for CBILS or BBLS affect a business’s credit history?

Multiple applications to the CBILS or BBLS in a short space of time may create a footprint on a borrower’s credit history. This will likely affect a borrower’s credit rating. Rejections may also harm credit ratings.

Once an application is successful, a lender will usually register a CBILS or BBLS loan with credit reference agencies. This means that a borrower’s credit ratings may be affected by any defaults under its CBILS or BBLS loan.

What impact could the CBILS or BBLS have on other lines of credit currently in existence?

Finance agreements often restrict the ability of a borrower (and potentially entities affiliated with a borrower or in the same corporate group) to incur debt in the future. As a consequence, if a CBILS or BBLS applicant already has existing debt, the applicant will need to carefully consider its existing finance agreements to determine if they permit a CBILS or BBLS loan, and, if they do permit the debt, whether any conditions need to fulfilled (such as the borrower needing to notify the existing lender). An open dialogue with existing lenders will often be helpful when navigating these issues. You should consider obtaining legal and financial advice if you have any concerns about incurring new debt and its impact on existing debt.

How do fees and interest rates compare to more traditional debt products?

How fees and interest rates compare to more traditional debt products varies between the CBILS and the BBLS:

- CBILS. Under the CBILS interest and fees are set by the lenders, much the same as traditional debt products. The main difference from traditional debt products is that the government will cover both interest and lender-levied fees on a CBILS facility for the first 12 months

- BBLS. The BBLS fee and interest structure varies significantly from traditional debt products. Interest is fixed by the government at 2.5 per cent per annum, and the government will cover the first 12 months of interest payments. There are no lender-levied fees under the BBLS

What types of finance are available?

The CBILS supports the following four types of finance:

- Term loans

This is a loan of a set principal amount that is repaid according to an agreed schedule. Usually, the entire value of the loan will be provided to the business on day one of the loan. The “principal” (such as the amount borrowed) will be repayable either (i) in instalments throughout the lifetime of the loan, or (ii) as a single “bullet” repayment at the end of the term. Interest is usually payable either (a) throughout the life of the loan at regular intervals (such as monthly), or (b) at the end of the loan term (a so-called “payment in kind” or “PIK” loan)

- Asset finance

Under asset finance, a borrower selects certain assets that they want to support their loan (for example, certain equipment or inventory), and a lender advances a loan based on the value of the assets put forward. As a condition of such a loan, the lender will usually take security over the assets in question (see “What are the main risks of using the CBILS and BBLS?” below for more on what this means and its implications). This form of finance allows businesses to “free up” cash from fixed assets, or to purchase items when a business has insufficient cash on hand to buy the asset outright (similar to a residential mortgage). The following are two examples of asset finance: (i) A business owns a tractor and needs some extra money to run its business. It goes to the bank and receives a loan based on the value of the tractor. To secure the loan, the bank takes security over the tractor. Whilst it still has the tractor, the business has freed up cash by using the tractor to support the loan. (ii) A business wants to purchase a new clothes manufacturing machine. A bank advances the required funds to the business so it can buy the new clothes manufacturing machine, as the business does not have sufficient spare cash to buy the machine outright. To secure the loan, the bank takes security over the acquired machine.

- Invoice finance

This is a loan that is made against a business’s invoices (such as receivables). Usually, lenders will advance a loan to the borrower based on the value of a borrower’s invoices, provided that the bank is granted security over the receivables in question (see “What are the main risks of using the CBILS and BBLS?” below for more on what this means and its implications). Invoice financing helps businesses improve cash flow, as borrowers can obtain cash before the receivables/invoices are due to be paid. The following is an example of invoice finance: a plumber is owed money for his work, but is not due to be paid for another four months. He could obtain invoice financing from a lender based on the invoice. The lender would provide funds to him now, so funds are received sooner than if he had waited to be paid. However, in return, the lender will take security over the invoice.

- Revolving credit and overdraft facilities

A revolving credit facility or overdraft is an agreement where a lender makes available a set amount that can be borrowed and repaid many times over throughout the lifetime of the loan agreement. A common example of such a facility is a credit card. Another example is an overdraft facility, which allows a bank account holder to “overdraw” its bank account on the promise that the account holder will repay the overdrawn amount (plus any fees and interest) within a certain time period.

The BBLS only supports term loans.

When will the various types of finance be appropriate for my business?

There are many factors that should be taken into account when determining what type of finance is appropriate for a business. Below are just a few of the factors that should be considered:

- Cash flow. Does the business need a set amount of cash immediately? If so, a term loan may be appropriate. Does the business have fluctuating working capital needs that vary from time to time? If so, a revolving credit or overdraft facility may be more appropriate. Or has revenue dried up due to the business temporarily hibernating? If this is the case, the business might have greater success with an asset-based loan

- Asset profile. The right loan for a business may depend on the kind of assets it has at its disposal. For example, a transport business may offer its vehicles as security in an asset finance transaction to “free up” cash, or a construction subcontractor with a large number of unpaid receivables might want to use invoice finance to ease the financial pain caused by delays in payment

- Ability to repay. Revenue streams will impact what repayment terms are appropriate. Businesses with continuing revenue may be able to support payments in instalments, whereas for businesses where it may take time for revenue to increase, a loan with a bullet repayment may be more appropriate

- Pricing and fees. Different loan products will have different pricing and fees. In general, the more risky a product is for the lender, the more expensive the product will be for the borrower. For example, it is likely that a term loan with a long maturity will be more expensive than one with a short maturity. Businesses should carefully consider the pricing of different debt products as this can materially impact the financial burden of taking out debt. As mentioned above, business should also be cognisant of their ability to pay pricing (such as interest) and fees when they fall due.

At the end of the day, the type of finance appropriate for a business will depend on the specific circumstances of the business – there is no “one size fits all” approach. Borrowers should consider obtaining financial advice to help determine the most appropriate form of finance for individual needs.

How long, on average, have lenders taken making decisions and depositing cash?

Each lender will have its own timeline and process. The BBLS application process is designed to take a matter of days, whereas the CBILS is projected to take four to six weeks. Ultimately, the length of any application process will depend on a number of factors, including whether a business has an existing relationship with a lender, the volume of requests a lender is currently facing and the strength of the business’s financials and business case.

Is it better for a business to apply with its regular business banking provider?

The British Business Bank’s official recommendation is that businesses apply for the CBILS or BBLS with regular business banking providers. This should help streamline the process due to the applicant’s existing relationship with the lender, which should already be familiar with the relevant business. It also aims to prevent lenders from becoming overwhelmed with applications from multiple sources. It is also noteworthy that some lenders will only accept CBILS or BBLS applications from existing customers.

What happens if a business defaults on a repayment?

If a borrower fails to make scheduled repayments, or breaches another term of the loan, the lender will have the right to take action against the borrower for its default. A default can have numerous serious consequences, including the entire amount of the loan becoming immediately due and payable, credit rating downgrades, enforcement under security or personal guarantees, and, in the most serious of scenarios, insolvency or bankruptcy.

It is important to remember that a CBILS or BBLS borrower will be liable for the loan in its entirety at all times. This is the case despite the government guarantee. The bank may have the right to seek repayment of a loan from the government if a borrower defaults, but if this occurs, then the government will have the right to seek repayment from the borrower in full. In other words, you would owe the money to the government.

If you are worried that you might default on your loan, you should consider talking to your lender in the first instance, as a lender will have standard processes in place to deal with this. You should also consider obtaining legal and financial advice.

For more information on the risks associated with the CBILS and BBLS, please “What are the main risks of using the CBILS and BBLS?” below.

What are the key steps that will make for a successful application?

Once you have identified a need for finance, its amount, and the form it will take (see “What types of finance are available?” and “When will the various types of finance be appropriate for my business?” above on these topics), you might be tempted to send an application at the earliest stage, and finalise the details further down the line. However, it is much better to ensure that, before you apply, you are aware of what will likely be required from you at each stage of the application process and beyond.

It is advisable to have all of the information that is likely required by a lender before making an application. At a minimum, you should ensure that you have sufficient documentation to demonstrate that:

- The business was viable before the pandemic

- The pandemic has had an adverse impact on the business

- Management has already taken actions to preserve cash within the business

- The business can recover with the help of the loan using a clear business plan

- You have a clear idea of the borrowing required and how it will be used

See “What kind of information should a business include in its CBILS application?” below for some concrete examples of what information might be required.

What kind of information should a business include in its CBILS application?

The precise documents and information that are required will vary depending on the lender, but are likely to include:

- A summary of your business

- The past three years’ financial statements, as well as solid monthly (or even weekly) management accounts and cash flow forecasts

- List of assets

- List of creditors

- Information on the business’ existing debt profile, including loans and other finance arrangements

- A business plan showing a clear path to recovery

- Directors’ personal information, CVs, and creditworthiness checks

- Relevant know-your-customer and anti-money-laundering information (such as passport and proof of address)

As discussed in “What are the key steps that will make for a successful application?” above, you will also need to provide evidence that:

- The business was viable before the pandemic

- The pandemic has had an adverse impact on the business

- Management has already taken actions to preserve cash within the business

- You have a clear idea of the borrowing required and how it will be used

Can subsequent amounts of money be applied for if the business does not apply for the top amount?

The government has not produced clear guidance on “topping up” scheme loans, and lenders are taking different views on this point. If you need to top up your loan you should have a discussion with your lender, which will be able to provide more detailed guidance.

Will repayments be affected by future economic changes such as the Bank of England’s interest rate?

This may be the case for certain CBILS loans, but not for BBLS loans.

Interest rates for a CBILS loan are set by individual lenders. If a lender provides a variable interest rate facility, interest rates are likely to be calculated using reference rates that fluctuate if the Bank of England base rate moves. The Bank of England changes its base rate in response to economic conditions. For example, it will reduce its rates if it needs to encourage borrowing and spending to stimulate a stalling economy, or increase its rates when inflation is rising too high. Therefore, subsequent economic changes could affect repayments if they trigger action by the Bank of England.

BBLS loans will not be influenced by changes to the Bank of England’s base rate. Interest under this scheme is fixed at 2.5 per cent per annum.

What are some commons reasons a CBILS application might be rejected?

To date, only half of CBILS applications have been successful. Businesses tend to fail at the affordability stage of the process, effectively meaning that a firm has been unable to demonstrate that it is capable of repaying the loan. This step can be particularly difficult for early-stage businesses and those with poor cash flows or credit ratings. See “What are the key steps that will make for a successful application?” and “What kind of information should a business include in its CBILS application?” above for information on what will helps make a successful application, and the information you might provide to ensure that you are meeting lenders’ criteria.

Applicants should familiarise themselves with the CBILS eligibility criteria, which consist of those set by the government/British Business Bank and those set by the lender to whom an application is made.

Government/British Business Bank Criteria

The Government/British Business Bank require that an applicant SME:

- Has an annual turnover of no more than £45,000,000 on a consolidated group basis

- Generates more than 50 per cent of its turnover from trading (such as the sale of goods or services – the CBILS does not support shell/holding companies), although registered charities and further education establishments are exempt from this requirement

- Self-certifies that it has been adversely affected by coronavirus

- Has a borrowing proposal which its chosen lender would consider viable but for the pandemic

- Requires a loan of up to £5m to support trading (primarily in the UK), such loan being for a term of up to six years for term loans and asset finance or three years for invoice finance and revolving credit/overdraft facilities

- If the SME is seeking to borrow £30,000 or more, must not have been classed as a “business in difficulty” on 31 December 2019

Additionally, the amount requested must be no more than:

- Twice the applicant’s 2019 (or predicted first two years’) wage bill

- No more than a quarter of the applicant’s 2019 total turnover

- Or the amount which the applicant would need to cover its regular expenses over the next 18 months (or, if the applicant is an employer of more than 250 people, 12 months)

Businesses in the following sectors are ineligible for CBILS support:

- Banks, insurers and reinsurers (but not insurance brokers)

- Public sector bodies

- Further education establishments (if they are grant-funded)

- Primary and secondary schools (if they are state-funded)

Lender-specific criteria

Lenders may also have individual eligibility criteria for CBILS loans. For example, most lenders will require certain financial statements, some will only lend to existing customers or SMEs in certain geographies (such as East Midlands) and others may require that an SME have applied to a high-street lender before applying to them. It is, therefore, paramount to research each lender’s eligibility criteria before making an application.

What are the main risks of using the CBILS and BBLS?

The main risks associated with the CBILS and BBLS arise in the event that you default on your loan repayments or otherwise breach your financing arrangements. The main risks associated with defaults are as follows:

- Acceleration. A common remedy against a defaulting borrower is for the lender to declare that the entire loan amount is immediately due and payable. This can significantly exacerbate existing financial difficulties, as payment of the loan will arise earlier than it would in ordinary course

- Cross-default. Businesses should carefully check existing finance documents to ensure that default under one loan (such as a CBILS or BBLS loan) does not cause an event of default or default under another loan (known as cross-default). Cross-default can have a domino effect, resulting in a borrower breaching several of its debt documents even though strictly speaking it has only breached one of them. In extreme scenarios, a borrower could end up having all of its debts immediately due and payable merely because it breached the conditions of one loan

- Enforcement of security. A lender will sometimes take “security” over certain of the borrower’s assets. This essentially means that the lender has the right to take control of those assets and sell them if a borrower defaults. Whilst security is not required under the BBLS, businesses that are contemplating using the CBILS should pay close attention to the security they are being asked to provide

- Enforcement of guarantees. A “guarantee” is a promise given by a third party to pay in place of the primary borrower if it is no longer able to keep up with repayments or otherwise meet its obligations. In addition to the guarantee given to lenders by the government, a lender might also require additional guarantees from third parties, such as other companies in the business’s group structure. A lender may also ask for a “personal guarantee”, which is where an individual (usually a director or owner of the borrowing business) agrees to repay the loan out of the individual’s own personal funds if required. Personal guarantees are not permitted under the BBLS but are permitted under the CBILS if (a) the loan is for more than £250,000 and (b) the guarantee is capped at 20 per cent of the outstanding balance of a loan. Personal guarantees should always be scrutinised carefully, as they can mean significant personal liability

- Credit rating downgrades. A lender may register a CBILS or BBLS borrower with credit reference agencies, and so a borrower’s credit ratings may be affected by any defaults

- Insolvency or bankruptcy. Ultimately, a company borrower’s inability to repay may give the scheme lender a right to place the borrower into insolvency proceedings. In the case of sole traders or partnerships, individuals may have bankruptcy proceedings commenced against them if they fail to repay a loan. If you find yourself potentially in this situation, you should obtain legal advice immediately

- Directors’ duties and personal liability. If the borrower is a company, then the company’s directors will have a number of duties that they owe to their company, including to promote the success of the company, and to exercise reasonable care, skill and diligence. Where a company is likely to become insolvent, these duties are owed to the company’s creditors. Breach of these duties may give rise to personal liability, including liability to contribute to the company’s assets, imprisonment or disqualification from acting as a director. Again, legal advice can help ensure that these duties and obligations are complied with.

Will getting money through the CBILS and/or BBLS prevent a business from securing other debt lines in the future?

Lenders will nearly always examine a borrower’s existing debt profile when considering whether to make credit available to the borrower, and so having existing debt – including a CBILS or BBLS loan – will likely influence your ability to raise further debt in the future. However, if the loan made under the CBILS or BBILS is repaid according to the payment schedule, and the borrower can demonstrate that it has sufficient liquidity to take on further debt, usage of the CBILS or BBLS will not necessarily prevent the borrower from securing other lines of credit in the future. Conversely, missed payments or other defaults under CBILS or BBLS facilities will make securing further debt more difficult.

Will a business be able to pause repayments once they start?

Primarily, whether a borrower is able to “pause” repayments will depend on the agreement it has with its lender. It is not, however, common to have arrangements whereby a borrower can stop and restart repayment schedules. Lenders may, however, have policies that allow a borrower to pause repayments in the event of hardship. If this is of relevance, borrowers should have a conversation with their lender, and consider taking legal and/or financial advice.

Although “start and stop” features are not common, it is not uncommon for loans to contain “repayment holidays”, which are an initial period for which a borrower is not required to make repayments. The CBILS and BBLS have differing approaches to repayment holidays:

- CBILS. Repayment holidays are offered at the discretion of the lender, but some lenders have offered repayment holidays of up to 24 months

- BBLS. There is a 12-month repayment holiday as standard at the beginning of the term, but there is no indication that further repayment holidays are being permitted later on

Is it possible to re-finance a CBILS or BBLS loan in the future?

Currently there is no government guidance on this point. There is no clear reason why this would not be possible, but this decision will likely fall to individual lenders.

What if a business is loss making?

As indicated in the response to question 19 above, there are limits on the amounts a business is eligible to borrow (if any) if it is in financial difficulties. These businesses will still have to provide all the information described in “What are the key steps that will make for a successful application?” and “What kind of information should a business include in its CBILS application?” above, and so businesses may struggle to pass lenders’ affordability assessments.

Regardless of whether a business is granted a CBILS or BBLS loan, loss-making businesses should consider whether further borrowing is advisable, because as indicated in the response to “What are the main risks of using the CBILS and BBLS?” above, taking on too much debt poses serious risks to both the struggling business and its management

Terms and conditions

Do not rely on information on this site

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, neither we nor Morrison & Foerster (“MoFo”) make any representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date. Neither we nor MoFo are responsible for websites we link to. Where our site contains links to other sites and resources provided by third parties, these links are provided for your information only. Such links should not be interpreted as approval by us or MoFo of those linked websites or information you may obtain from them. We have no control over the contents of those sites or resources.

Our responsibility for loss or damage suffered by you

Whether you are a consumer or a business user: Neither we nor MoFo exclude or limit in any way our liability to you where it would be unlawful to do so. This includes liability for death or personal injury caused by our negligence or the negligence of our employees, agents or subcontractors and for fraud or fraudulent misrepresentation. If you are a business user: (a) Both we and MoFo exclude all implied conditions, warranties, representations or other terms that may apply to our site or any content on it. (b) Neither we nor MoFo will be liable to you for any loss or damage, whether in contract, tort (including negligence), breach of statutory duty, or otherwise, even if foreseeable, arising under or in connection with: (i) use of, or inability to use, our site; or (ii) use of or reliance on any content displayed on our site. (c) In particular, we will not be liable for: (i) loss of profits, sales, business, or revenue; (ii) business interruption; (iii) loss of anticipated savings; (iv) loss of business opportunity, goodwill or reputation; or (v) any indirect or consequential loss or damage. If you are a consumer user: (a) Please note that we only provide our site for domestic and private use. You agree not to use our site for any commercial or business purposes, and both we and MoFo have no liability to you for any loss of profit, loss of business, business interruption, or loss of business opportunity. (b) If defective digital content that we have supplied, damages a device or digital content belonging to you and this is caused by our failure to use reasonable care and skill, we will either repair the damage or pay you compensation.

Finance

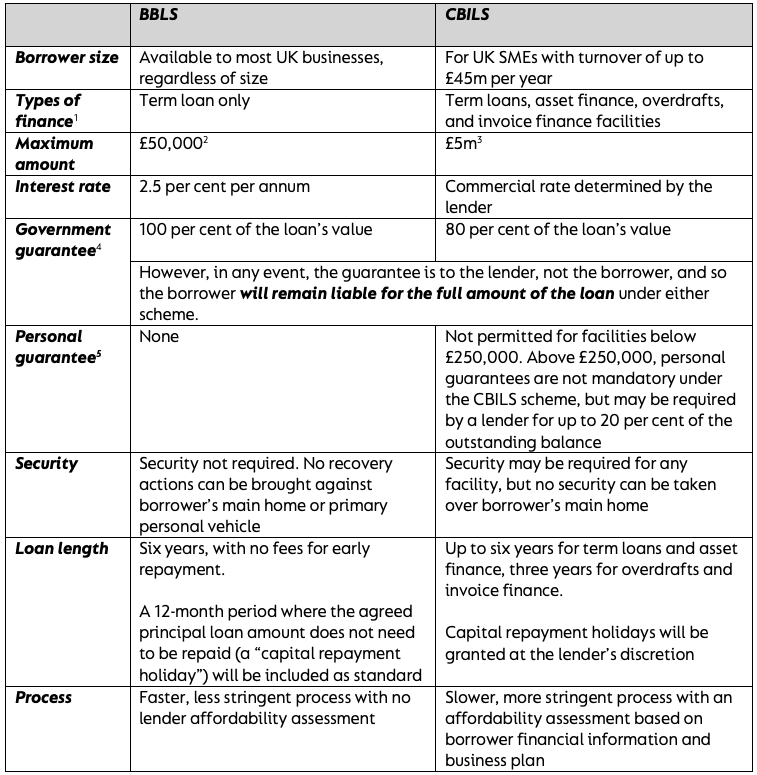

The government’s Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loans Scheme (BBLS) were launched to provide UK businesses with short- and long-term working capital support.

The government’s Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loans Scheme (BBLS) were launched to provide UK businesses with short- and long-term working capital support.